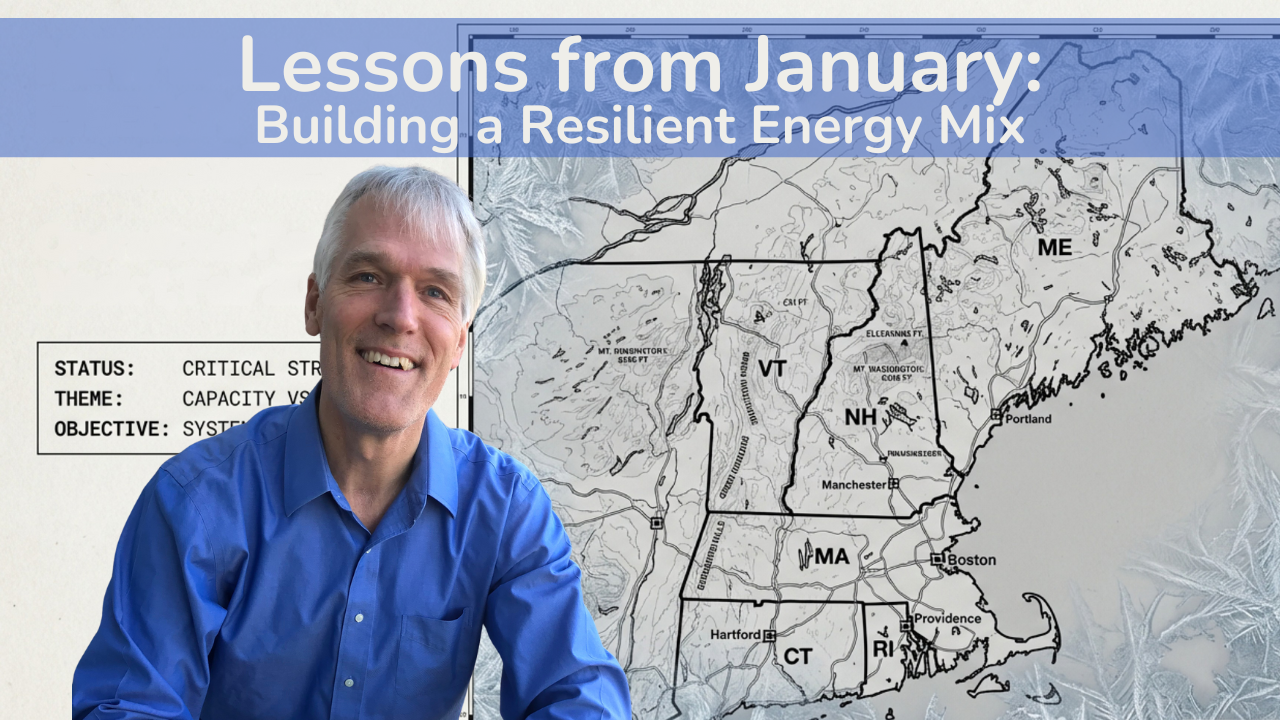

Let’s explore the complexity associated with keeping the lights, using New England as an example. The region is a bit of an outlier because of its proverbial end-of-the-pipeline location. Most days, its two pipelines are sufficient to heat homes and generate power. But late January to early February was unusually cold and there was not enough gas for both.

We’ll look at both energy and capacity issues. Capacity is the instantaneous amount of electricity produced or consumed. Energy is a function of capacity times the duration.

The hottest and coldest days are the ones in which we stress the grid the most – because of heating and cooling demands.

Annual grid peaks typically occur in summer, around 5:00 or 6:00 PM. So grids need enough generation to meet the peak demand, plus a back-up reserve margin, in case we lose a big power plant or transmission line.

Until recently, ISO-NE only paid attention to summer peaks, when the system maxed out. But recently, it began to shift its attention to the winter as well. First, because new loads, especially EVs and heat pumps, have higher winter demand. Second, there’s not enough gas to go around.

Fortunately, from a reliability perspective, the region’s dual fuel turbines can burn fuel oil or kerosene, and even jet fuel. So the focus shifts to energy, because the amount of stored liquid fuels is limited, though it can be replenished – especially if weather cooperates. During the frigid cold snap in 2017/2018, New England started with 5 million barrels of oil and ended with only one, in one case burning a million gallons in a single day.

During the extreme cold this January, fuel oil was the leading source of generation for several days, constituting over one-third of operating generation.

One new resource just commissioned was the 1200 MW New England Clean Energy Connect (NECEC) transmission line, bringing hydropower from Quebec to Massachusetts with a contract for an annual 9,555,000 MWh. The NECEC line was expected to help address winter capacity and energy issues.

But last week, no power was flowing into New England over that line on the coldest days. On the frigid Sunday before the storm, power flowed for only a single hour, with the line operating at about half its capacity. The following day, at around 6:00 in the evening, electricity started flowing again at about 25% - this despite penalties for non-delivery.

However, the contract does provide a measure of relief to those oil supplies in the long run. Today, January 3rd, the temps are in the mid-20s. The region continues to burn oil, at 23%.

But net imports right now, including the HQ NECEC contract, make up 16%.

That electricity represents expensive oil inventories we are not burning. Offshore wind – Vineyard Wind has helped as well.

So does rooftop solar, cutting demand by up to roughly 3,500 MW for a good chunk of the day – that’s also largely fuel oil we don’t have to burn. Which matters, since the forecast for the weekend is for wind chills dropping into the negative teens on Sunday night.

It’s clear over-reliance on a single source of supply is a risky strategy, and an all-of-the-above approach helps keep the lights on during those coldest of days.